Day Trading vs. Long-Term Cryptocurrency HODLing: Benefits and Drawbacks When it comes to cryptocurrency investment, there are two major approaches investors often consider: day trading and long-term HODLing. These strategies have distinct advantages and challenges, and choosing the right one can make or break your crypto portfolio.

- Do you enjoy taking advantage of short-term price movements and making quick profits?

- Or do you believe in the long-term potential of a cryptocurrency, willing to weather the market’s ups and downs for future gains?

Understanding the benefits and drawbacks of both methods is crucial to making the right decision for your investment strategy. In this article, we’ll break down day trading and HODLing, highlighting the key differences and helping you determine which approach aligns with your financial goals, risk tolerance, and time commitment.

Day trading and cryptocurrency HODLing are two popular investment strategies in the crypto world. Both aim to maximize returns, but they differ significantly in approach and risk.

Day trading is a short-term, high-risk strategy where traders buy and sell cryptocurrencies within the same day to capitalize on rapid price fluctuations. It’s a fast-paced method that requires constant market monitoring and quick decision-making.

On the other hand, HODLing (derived from a misspelled “hold”) refers to buying and holding cryptocurrency for the long term, hoping for significant appreciation in value. This term became famous after a 2013 post on the Bitcointalk forum and is now widely used by crypto enthusiasts, with many interpreting it as “hold on for dear life.”

Key Differences: Day Trading vs. HODLing

Day trading involves in-depth technical analysis, strict self-discipline, and quick decision-making. Traders use various strategies to profit from market movements, such as technical analysis and chart patterns, mirroring traditional stock trading methods. However, cryptocurrency’s market volatility provides opportunities for higher and faster returns.

In contrast, HODLing is more about commitment and belief in the long-term potential of a cryptocurrency. Investors typically purchase assets they support and believe will rise in value over time. This approach requires less frequent trading and a strong tolerance for market fluctuations.

The Evolution of Online Trading

With online platforms, cryptocurrency investors can execute trades independently, without the need for brokers or financial institutions, unlike in traditional stock markets. This opens up access to crypto trading for a wider audience. Furthermore, the cryptocurrency market operates 24/7, 365 days a year, offering constant opportunities for high returns due to its perpetual volatility.

Cryptocurrency has revolutionized trading by providing both institutional and retail investors with new approaches while maintaining and enhancing traditional tools. So, which strategy should you choose: HODLing or active day trading?

What Is Cryptocurrency Day Trading?

Day trading refers to entering and exiting positions within the same trading day, aiming to profit from short-term market fluctuations. This strategy demands a deep understanding of the market and extensive experience.

Traders rely heavily on technical analysis (TA), using indicators like volume, price action, and chart patterns to determine the best entry and exit points. So, is day trading profitable? It can be highly profitable, but it depends on your trading style and goals. It’s a risky approach that requires fast decision-making, so it’s often stressful and demanding.

Day traders aim to profit from even the smallest price movements in the volatile crypto market. In comparison to stocks or commodities, the crypto market’s wild price swings offer higher profit potential, with the possibility of seeing a large price spike within a single day.

However, risk management is critical for success in day trading, as is the proper use of technical indicators. Liquidity also plays a crucial role. In a volatile market, the ability to execute quick trades is essential, especially when exiting positions. More liquid trading pairs increase the chances of successfully executing trades.

While fundamental analysis is not as important in day trading, staying informed on the latest crypto news can provide insights into market sentiment and potential short-term price shifts.

Common Day Trading Strategies

- Scalping: This strategy focuses on making small profits from minor price movements within minutes of entering a trade. Scalpers often use high trading volumes and leverage (margin trading) to amplify profits.

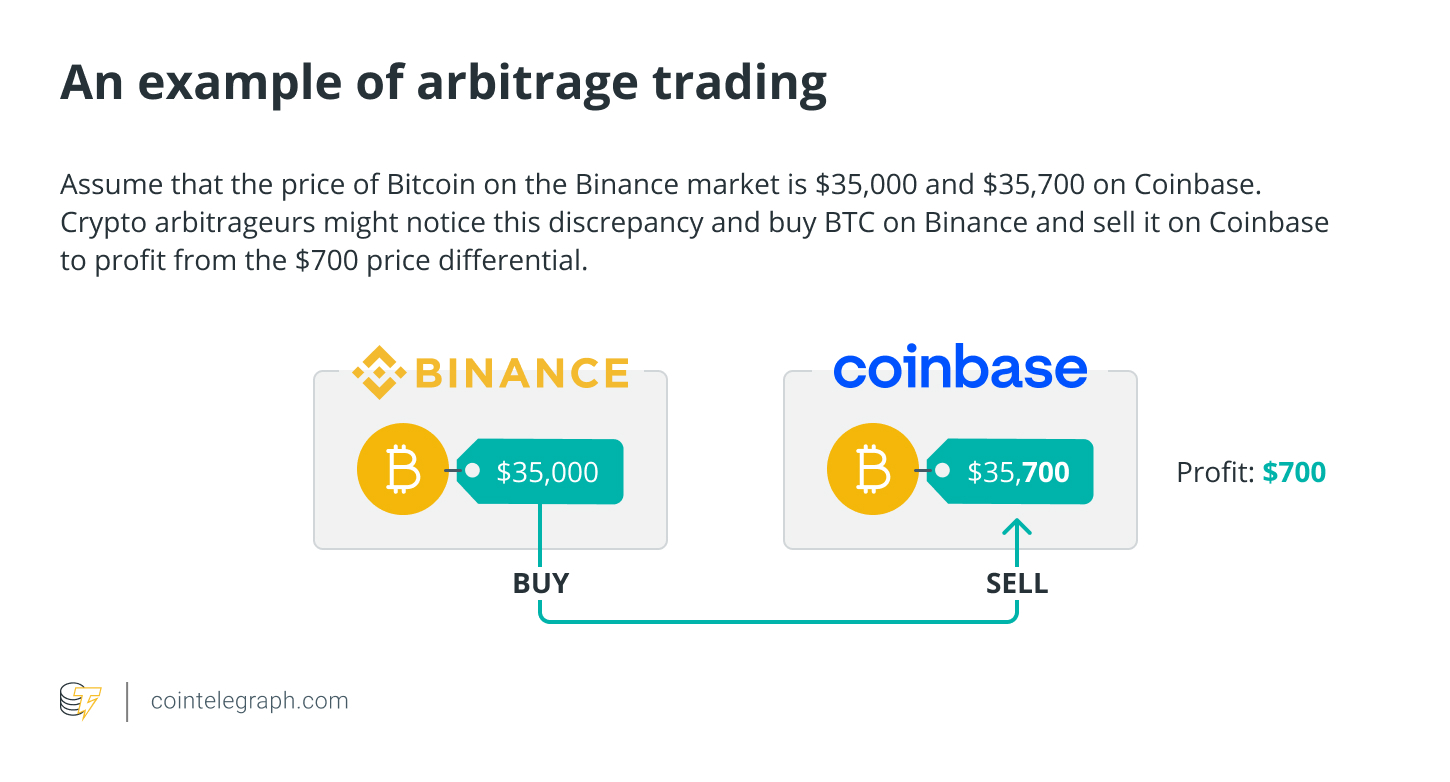

- Arbitrage: This involves exploiting price differences between cryptocurrency exchanges. Traders buy an asset on one platform where the price is lower and sell it on another where the price is higher. Even small price differences can yield considerable profits if a large amount of cryptocurrency is traded quickly between platforms.

What is a Cryptocurrency HODLing Strategy?

HODLing is a straightforward, long-term investment strategy in the cryptocurrency market. The concept involves purchasing a cryptocurrency and holding it in a secure wallet for an extended period—typically years—until the investment has appreciated enough to sell at a satisfying profit. Those who HODL are often called “hodlers,” and they generally resist selling even when market prices fluctuate significantly.

Why Choose HODLing?

One of the main advantages of HODLing is that it allows investors to avoid the stress of short-term market volatility. Instead of reacting to every price swing, hodlers take a patient, long-term approach. This strategy helps investors steer clear of the common pitfall of buying high and selling low, which is all too frequent in the crypto market. True hodlers often hold onto their assets through market crashes or periods of volatility, believing in the long-term potential of their chosen cryptocurrency.

How Long Should You Hold Crypto?

The answer to this depends on your investment strategy and personal beliefs. For example, many Bitcoin (BTC) investors, despite the volatility, believe in holding their assets for the long haul, even forever. They trust that Bitcoin will eventually become a widely adopted global monetary system, surpassing government-issued currencies. If this happens, the exchange rates between cryptocurrencies and fiat money may become irrelevant, allowing hodlers to maintain their holdings without concern for short-term price changes.

Dollar-Cost Averaging (DCA) in HODLing

A common tactic used by hodlers is dollar-cost averaging (DCA). This approach involves investing small amounts into a cryptocurrency over time, regardless of the asset’s price fluctuations. By doing so, investors reduce the impact of market volatility, and the strategy removes emotions from the investment process. Instead of reacting to FOMO (Fear of Missing Out) or FUD (Fear, Uncertainty, and Doubt), hodlers stick to a set plan, gradually accumulating cryptocurrency and avoiding the temptation to make impulsive decisions based on short-term market conditions.

Choosing the Right Coin to HODL

When it comes to selecting a cryptocurrency to HODL, it’s crucial to carefully assess the potential of the asset. Most experienced hodlers tend to favor top-market-cap coins like Bitcoin and Ethereum, as these projects are generally more established, with stronger security and growth potential compared to smaller, less proven coins.

The cryptocurrency market is vast, with thousands of coins and tokens. However, many of these projects may not stand the test of time. As such, choosing the right cryptocurrency to hold long-term requires thorough research. Investors should focus on established projects with a solid use case and long-term vision. Additionally, securing your digital assets in a reliable wallet or storage solution is critical for protecting your investments.

The Bigger Picture: Avoiding Mistakes in HODLing

HODLing isn’t just about picking the right coins—it’s also about having a clear, long-term perspective. Focusing on long-term trends, rather than short-term price movements, will help prevent making regrettable mistakes, such as selling too early or panic-selling during market downturns. Patience and consistency are key components of a successful HODLing strategy.

Day Trading Cryptocurrency: Quick Profits and High Risk

Day trading involves buying and selling cryptocurrency within short time frames—ranging from minutes to hours—seeking to profit from small price fluctuations. This strategy demands quick decisions, constant market monitoring, and the ability to react quickly to news or price swings.

Benefits of Day Trading:

- High Profit Potential: By taking advantage of market volatility, day traders can make significant gains in a short period.

- Frequent Trading Opportunities: With the constant price fluctuations in crypto markets, day traders have multiple opportunities to buy low and sell high.

- Leverage: Advanced traders may use margin trading to increase their potential returns (though it also amplifies risk).

Drawbacks of Day Trading:

- High Risk: Due to the volatility of cryptocurrencies, day trading carries the risk of significant losses in a short time.

- Stress and Time Commitment: It requires constant attention to market movements and the ability to react quickly to changing conditions.

- Fees and Taxes: With frequent transactions, day traders may incur higher trading fees and tax liabilities.

Long-Term HODLing: The Strategy for Patience

On the other hand, HODLing—a term derived from the word “hold”—is a long-term investment strategy where investors purchase cryptocurrency and hold onto it, regardless of short-term price fluctuations, in anticipation of significant long-term gains.

Benefits of HODLing:

- Less Stress: Once you’ve invested, HODLing requires much less time and emotional energy, as you are not actively monitoring the market.

- Potential for Big Gains: If you pick the right cryptocurrency, long-term holding has the potential for substantial returns as the value appreciates over time.

- Lower Fees and Taxes: Fewer transactions mean lower fees and the potential for lower tax rates (depending on your country’s tax laws).

Drawbacks of HODLing:

- Opportunity Cost: While holding long-term, you may miss out on opportunities to profit from short-term market movements.

- Volatility Risks: Long-term investors must be prepared to weather major market corrections or bear markets without panicking.

- Locked-In Capital: Your funds are tied up in a single investment for an extended period, limiting your ability to react to other opportunities.

Which Strategy Is Right for You?

Choosing between day trading and HODLing depends largely on your investment goals, risk tolerance, and time commitment. Let’s summarize the key differences:

| Criteria | Day Trading | Long-Term HODLing |

|---|---|---|

| Profit Potential | High, but short-term | High, but long-term |

| Risk | High, frequent fluctuations | Moderate, depends on market performance |

| Time Commitment | High, requires constant attention | Low, less monitoring needed |

| Stress Level | High, fast decisions required | Low, patience is key |

| Transaction Fees | Higher due to frequent trades | Lower, fewer transactions |

May you also like it:

What is Multi-Factor Authentication (MFA)? Benefits & How It Works

Non-Fungible Tokens Claim No. 1 Spot in Art World Power List

How Digital Art Has Fared Since the NFT Boom (2025)

Conclusion

Ultimately, whether you choose day trading or HODLing depends on your investment style and lifestyle preferences. If you enjoy making quick decisions and have the time to dedicate to constant market analysis, day trading might be your best bet. However, if you have a longer-term outlook and prefer a less stressful investment approach, HODLing might be the way to go.

Remember, both strategies come with their own risks and rewards. It’s crucial to do thorough research, evaluate your risk tolerance, and decide on an approach that suits your financial goals. No matter the route you take, the key to success in cryptocurrency investing is patience and discipline.

FAQs

1. What is day trading in cryptocurrency?

Day trading is a strategy where traders buy and sell crypto within short periods, aiming to profit from daily price fluctuations.

2. What does HODLing mean?

HODLing refers to holding onto your cryptocurrency for the long term, regardless of short-term market movements.

3. Can day trading be profitable in crypto?

Yes, but it requires expertise, constant monitoring, and the ability to manage risk effectively.

4. Is HODLing safe? HODLing can be safer as it involves less frequent trading and may lead to greater long-term returns, but it’s still subject to market volatility.

5. What are the risks of day trading?

Day trading is high risk, especially in volatile markets like cryptocurrency, and requires time, skill, and emotional control.

6. Which is better for beginners: day trading or HODLing?

HODLing is generally better for beginners, as it requires less active involvement and allows for a long-term growth strategy.